In the ever-evolving world of investment, mastering the art of portfolio management is essential for achieving financial success. As we move through 2024, the integration of advanced investment calculations into portfolio management practices can provide a significant edge. This guide explores how to effectively use investment calculations to optimize your portfolio and make informed financial decisions.

1. Understanding Investment Calculations

Investment calculations are mathematical techniques used to analyze and predict the performance of investments. They help investors assess risks, returns, and the overall health of their portfolios. In 2024, the sophistication of these calculations has increased with advancements in technology and data analytics, making them more critical than ever.

Key Investment Calculations to Know

- Compound Annual Growth Rate (CAGR):

- Definition: CAGR measures the mean annual growth rate of an investment over a specified time period longer than one year.

- Formula: CAGR=VfVi1n−1\text{CAGR} = \frac{V_f}{V_i}^\frac{1}{n} – 1CAGR=ViVfn1−1

- VfV_fVf: Final Value

- ViV_iVi: Initial Value

- nnn: Number of Years

- Usage: Helps in understanding the true growth rate of your investments, smoothing out annual fluctuations.

- Standard Deviation:

- Definition: Measures the volatility or risk of an investment by quantifying the amount of variation from the average return.

- Formula: σ=1N∑i=1N(Ri−μ)2\sigma = \sqrt{\frac{1}{N} \sum_{i=1}^{N} (R_i – \mu)^2}σ=N1∑i=1N(Ri−μ)2

- RiR_iRi: Each individual return

- μ\muμ: Mean return

- NNN: Number of returns

- Usage: Assists in assessing the risk associated with an investment or portfolio.

- Sharpe Ratio:

- Definition: Evaluates the return of an investment compared to its risk, calculated as the ratio of the excess return to the standard deviation.

- Formula: Sharpe Ratio=Rp−Rfσp\text{Sharpe Ratio} = \frac{R_p – R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

- RpR_pRp: Return of the Portfolio

- RfR_fRf: Risk-Free Rate

- σp\sigma_pσp: Standard Deviation of the Portfolio

- Usage: Measures how well the return compensates for the risk taken, guiding decisions on whether to add or remove assets.

- Alpha and Beta:

- Alpha: Indicates the excess return of an investment relative to its benchmark index.

- Formula: α=Ri−(Rf+β×(Rm−Rf))\alpha = R_i – (R_f + \beta \times (R_m – R_f))α=Ri−(Rf+β×(Rm−Rf))

- RiR_iRi: Investment Return

- RfR_fRf: Risk-Free Rate

- β\betaβ: Beta of the Investment

- RmR_mRm: Market Return

- Formula: α=Ri−(Rf+β×(Rm−Rf))\alpha = R_i – (R_f + \beta \times (R_m – R_f))α=Ri−(Rf+β×(Rm−Rf))

- Beta: Measures an investment’s volatility relative to the market.

- Formula: β=Covariance(Ri,Rm)Variance(Rm)\beta = \frac{\text{Covariance}(R_i, R_m)}{\text{Variance}(R_m)}β=Variance(Rm)Covariance(Ri,Rm)

- Covariance and Variance are statistical measures of the relationship between returns of the investment and the market.

- Formula: β=Covariance(Ri,Rm)Variance(Rm)\beta = \frac{\text{Covariance}(R_i, R_m)}{\text{Variance}(R_m)}β=Variance(Rm)Covariance(Ri,Rm)

- Alpha: Indicates the excess return of an investment relative to its benchmark index.

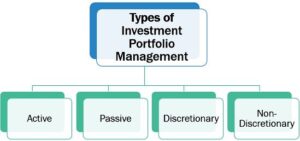

2. Applying Investment Calculations to Portfolio Management

Portfolio Diversification

Diversification is a key strategy in managing risk within a portfolio. By applying calculations like standard deviation and beta, you can assess the risk associated with different assets and create a balanced portfolio that minimizes volatility. For example, combining assets with low correlation can reduce overall portfolio risk.

Performance Evaluation

Regularly using CAGR and Sharpe Ratio calculations allows you to evaluate the performance of your portfolio over time. This helps in determining whether your investments are meeting your financial goals and whether adjustments are needed. A higher CAGR indicates better growth, while a higher Sharpe Ratio signifies better risk-adjusted returns.

Risk Management

Understanding and managing risk is crucial. Standard deviation and beta provide insights into the volatility of individual investments and the portfolio as a whole. By monitoring these metrics, you can make informed decisions to adjust your portfolio’s risk profile according to your risk tolerance and market conditions.

Asset Allocation

Effective asset allocation involves distributing investments across various asset classes (e.g., stocks, bonds, real estate) based on your financial goals and risk tolerance. Investment calculations like alpha and beta help in selecting assets that complement each other and fit within your desired risk-return profile.

3. Leveraging Technology and Tools

In 2024, technology has revolutionized investment calculations with the advent of advanced financial tools and platforms. Utilizing portfolio management software and financial calculators can streamline the process of applying investment calculations. These tools provide real-time data, automate complex calculations, and offer insightful analytics to guide your investment decisions.

Recommended Tools

- Bloomberg Terminal: Provides comprehensive financial data and sophisticated analytical tools.

- Morningstar Direct: Offers investment analysis, portfolio management, and performance tracking.

- Robo-Advisors: Utilize algorithms to manage and optimize portfolios based on calculated metrics.

4. Best Practices for Effective Portfolio Management

Regular Reviews and Adjustments

Continuous monitoring and recalibration of your portfolio based on investment calculations are essential. Conduct quarterly or annual reviews to assess performance against benchmarks and make necessary adjustments.

Stay Informed

Keep abreast of market trends, economic indicators, and financial news. Understanding the broader economic environment can provide context for your calculations and influence your investment strategies.

Seek Professional Advice

Consider consulting with financial advisors who can provide expert insights and help you interpret investment calculations effectively. Their expertise can guide you in optimizing your portfolio and achieving your financial goals.

Conclusion

Effective portfolio management in 2024 relies heavily on the strategic use of investment calculations. By mastering these calculations and integrating them into your portfolio management practices, you can enhance your investment decisions, manage risk more effectively, and achieve your financial objectives. Embrace the tools and technologies available, stay informed, and regularly review your portfolio to ensure its alignment with your goals and risk tolerance.