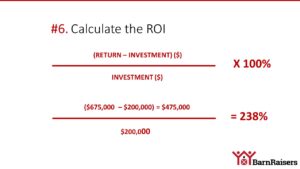

As we approach 2024, the landscape of investment is evolving with cutting-edge technologies and advanced calculation tools designed to help investors maximize their returns on investment (ROI). In this article, we’ll explore the most innovative investment calculation tools available this year, and how they can revolutionize your investment strategies.

1. The Importance of Investment Calculation Tools

Investment calculation tools are crucial for investors aiming to make informed decisions. They help in assessing potential returns, understanding risk factors, and optimizing investment strategies. As financial markets become increasingly complex, having access to sophisticated tools can provide a significant advantage.

2. Top Innovative Investment Calculation Tools for 2024

a. AI-Powered Investment Calculators

Artificial Intelligence (AI) is transforming the investment landscape. AI-powered calculators use machine learning algorithms to analyze vast amounts of data, providing more accurate predictions of market trends and potential returns. Tools such as AlphaSense and Kavout offer real-time insights and predictive analytics that can help investors make data-driven decisions.

Key Features:

- Real-time data analysis

- Predictive analytics

- Customizable algorithms for different investment strategies

b. Blockchain-Based Investment Trackers

Blockchain technology is not only revolutionizing cryptocurrencies but also enhancing investment tracking. BlockFi and Coinbase provide transparent and secure platforms for managing and tracking investments. These tools ensure data integrity and provide investors with detailed insights into their portfolios.

Key Features:

- Secure and transparent transactions

- Detailed portfolio tracking

- Integration with various cryptocurrencies and traditional assets

c. Cloud-Based Portfolio Management Software

Cloud-based portfolio management tools like Personal Capital and Wealthfront offer comprehensive solutions for tracking and managing investments. These platforms provide real-time updates, advanced analytics, and automated investment advice. Cloud technology ensures that data is accessible from anywhere and is constantly updated.

Key Features:

- Real-time updates and alerts

- Comprehensive portfolio analysis

- Automated investment recommendations

d. Augmented Reality (AR) Investment Visualization Tools

Augmented Reality (AR) is making waves in the financial sector by offering immersive investment visualization tools. Visualize and E*TRADE have integrated AR to provide investors with a more interactive and engaging way to analyze their investments. These tools can help in visualizing market trends, portfolio performance, and risk factors.

Key Features:

- Interactive 3D visualizations

- Enhanced market trend analysis

- Risk assessment through immersive technology

3. How to Choose the Right Investment Calculation Tool

Selecting the right tool depends on various factors, including your investment goals, risk tolerance, and preferred investment strategies. Here are some tips to help you choose the best tool for your needs:

a. Assess Your Needs

Identify what you want to achieve with the tool. Are you looking for detailed market analysis, risk management, or portfolio tracking? Different tools offer different features, so choose one that aligns with your goals.

b. Evaluate Features and Capabilities

Consider the features offered by each tool. Look for advanced analytics, real-time data updates, and ease of use. Ensure that the tool provides the functionality you need to make informed investment decisions.

c. Check Integration Options

Ensure that the tool integrates seamlessly with your existing financial systems and accounts. Compatibility with other financial platforms can streamline your investment management process.

d. Read Reviews and Testimonials

Research user reviews and testimonials to gauge the effectiveness and reliability of the tool. Feedback from other investors can provide valuable insights into the tool’s performance and customer support.

4. Benefits of Using Advanced Investment Calculation Tools

a. Enhanced Accuracy

Advanced tools use sophisticated algorithms and real-time data to provide more accurate predictions and analyses. This can lead to better decision-making and increased ROI.

b. Improved Efficiency

Automated features and real-time updates streamline the investment management process, saving time and reducing the likelihood of errors.

c. Better Risk Management

Sophisticated tools offer detailed risk assessments and analytics, helping investors identify potential risks and mitigate them effectively.

d. Personalized Insights

AI and cloud-based tools can provide personalized investment recommendations based on your specific goals and preferences.

5. Conclusion

As we move into 2024, the evolution of investment calculation tools continues to enhance the way investors manage their portfolios and make investment decisions. From AI-powered calculators to blockchain-based trackers and AR visualization tools, these innovations are designed to help investors maximize their ROI and stay ahead in a competitive market. By choosing the right tools and leveraging their advanced features, you can optimize your investment strategies and achieve your financial goals with greater precision.