Introduction

Compound interest is one of the most powerful financial concepts, capable of significantly growing your savings over time. Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on both the principal and the accumulated interest. This compounding effect can turn modest investments into substantial sums with patience and strategic planning. In this article, we’ll explore how compound interest works, provide expert tips for maximizing its benefits, and recommend tools for effective investment planning.

Understanding Compound Interest

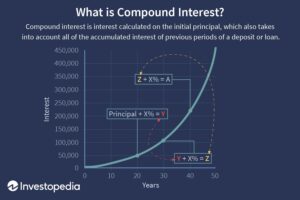

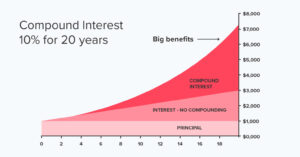

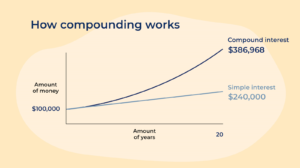

Compound interest refers to the process where the interest earned over time is added to the principal amount, creating a new principal. This means that future interest is calculated on the new principal, which includes previously earned interest. This cycle of earning interest on interest accelerates the growth of your savings.

For example, if you invest $1,000 at an annual interest rate of 5%, the interest earned in the first year is $50, making the total $1,050. In the second year, the interest is calculated on $1,050, not just the initial $1,000. This results in $52.50 in interest for the second year, and so on. Over time, this compounding effect leads to exponential growth of your savings.

The Power of Compound Interest

The power of compound interest lies in its ability to generate returns on returns. The earlier you start investing, the more you benefit from compounding. The longer your money has to grow, the greater the impact of compound interest. This principle is often referred to as “the miracle of compounding.”

Expert Tips for Maximizing Compound Interest

- Start Early: The earlier you begin investing, the more time your money has to compound. Even small contributions made early in life can grow significantly due to the long-term compounding effect.

- Reinvest Earnings: Ensure that any interest or dividends earned are reinvested rather than withdrawn. Reinvesting allows you to benefit from compound interest on both your initial investment and the returns generated.

- Regular Contributions: Make regular contributions to your investment accounts. Consistent investing, even in small amounts, can enhance the compounding effect and grow your savings more rapidly.

- Choose High-Interest Accounts: Look for investment accounts or financial products that offer higher interest rates. Higher rates lead to more substantial compounding effects over time.

- Be Patient: Compound interest takes time to build. Avoid the temptation to withdraw your funds prematurely. Stay invested and let the power of compounding work for you.

- Diversify Investments: Diversifying your investments can help manage risk and potentially increase returns. Consider a mix of stocks, bonds, and other assets to optimize your investment strategy.

Tools for Effective Investment Planning

- Compound Interest Calculators: Online compound interest calculators can help you estimate how your savings will grow over time. Input your principal amount, interest rate, and investment duration to see potential outcomes.

- Investment Apps: Many investment apps offer tools for tracking and managing your investments. Look for apps that provide compound interest calculations, automated contributions, and performance tracking.

- Financial Planning Software: Comprehensive financial planning software can assist in creating long-term investment strategies. These tools often include features for calculating compound interest, forecasting future savings, and analyzing investment performance.

- Retirement Calculators: Retirement calculators help project how compound interest will affect your retirement savings. They consider factors like retirement age, contributions, and expected returns to provide a clear picture of your retirement readiness.

Common Mistakes to Avoid

- Neglecting to Reinvest Earnings: Failing to reinvest interest or dividends can hinder the compounding process. Ensure all returns are reinvested to maximize growth.

- Withdrawing Early: Withdrawing funds before they have had time to compound can significantly reduce potential gains. Aim to keep your investments intact for the long term.

- Ignoring Fees: Investment fees can erode your returns. Be mindful of account fees, transaction costs, and management fees, and choose low-cost investment options when possible.

- Inconsistent Contributions: Irregular contributions can disrupt the compounding process. Try to maintain consistent contributions to benefit fully from compound interest.

Conclusion

Compound interest is a powerful tool for growing your savings and investments over time. By understanding its mechanics and applying expert tips, you can leverage its benefits to achieve your financial goals. Start early, reinvest earnings, and use available tools to plan and monitor your investments effectively. With patience and strategic planning, the compounding effect can significantly transform your financial future.