Introduction

Compound interest is a powerful financial principle that can significantly boost your wealth over time. Unlike simple interest, which is calculated only on the principal amount, compound interest earns interest on both the initial principal and the accumulated interest from previous periods. Understanding and leveraging compound interest can lead to substantial long-term financial growth. In 2024, optimizing this principle is more important than ever. This article explores how compound interest impacts financial growth and offers strategies to maximize returns in the current economic landscape.

Understanding Compound Interest

At its core, compound interest involves reinvesting interest earned to generate additional earnings. The formula for compound interest is:

A=P(1+rn)ntA = P \left(1 + \frac{r}{n}\right)^{nt}A=P(1+nr)nt

where:

- AAA is the amount of money accumulated after nnn years, including interest.

- PPP is the principal amount (the initial sum of money).

- rrr is the annual interest rate (decimal).

- nnn is the number of times that interest is compounded per year.

- ttt is the number of years the money is invested or borrowed for.

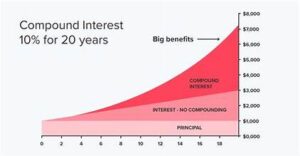

The power of compound interest lies in its ability to grow wealth exponentially. As time progresses, the amount of interest earned increases, leading to a snowball effect that accelerates financial growth.

The Impact of Compound Interest on Long-Term Financial Growth

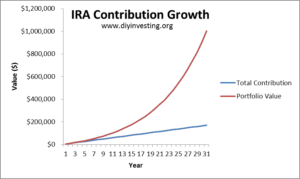

- Exponential Growth: Unlike linear growth from simple interest, compound interest grows exponentially. This means that the longer your money is invested, the greater the growth. For example, a $1,000 investment at an annual compound interest rate of 5% will grow to approximately $1,628 over 10 years, compared to just $1,500 with simple interest.

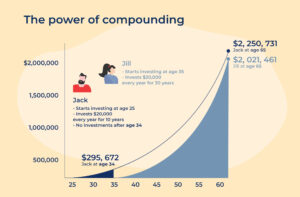

- Time Horizon: The effect of compound interest becomes more pronounced over longer time periods. Investing early in life allows for more time to benefit from compounding. Even modest contributions can lead to significant wealth accumulation if given enough time to grow.

- Frequency of Compounding: The more frequently interest is compounded, the more you earn. Daily compounding, for instance, results in slightly higher returns than monthly or annual compounding, due to the interest being calculated and added to the principal more often.

Strategies for Maximizing Returns in 2024

- Start Early and Invest Consistently: Begin investing as early as possible to take full advantage of compound interest. Consistent contributions, even if small, can significantly enhance your returns over time. Utilize retirement accounts like IRAs and 401(k)s, which offer tax advantages and compound interest benefits.

- Choose High-Interest Accounts: Look for savings accounts, certificates of deposit (CDs), or investment options that offer competitive interest rates. High-yield savings accounts and investments with higher annual percentage yields (APYs) can help maximize your returns.

- Reinvest Earnings: Ensure that any interest, dividends, or capital gains are reinvested. This practice not only increases the principal amount but also boosts the overall growth rate of your investment. Many investment platforms offer automatic reinvestment options.

- Diversify Investments: Diversification can enhance your potential returns while managing risk. Invest in a mix of assets, including stocks, bonds, real estate, and mutual funds. Diversified portfolios often benefit from compound interest across various sectors and asset classes.

- Monitor and Adjust: Regularly review your investments and adjust your strategy based on performance and market conditions. In 2024, staying informed about economic trends and adjusting your portfolio accordingly can help you maintain optimal growth.

- Utilize Tax-Advantaged Accounts: Take advantage of tax-advantaged accounts to maximize your compound interest benefits. Contributions to Roth IRAs, 401(k)s, and other tax-advantaged accounts can grow tax-free, allowing your investments to compound without immediate tax implications.

- Minimize Debt: Compound interest can also work against you when it comes to debt. High-interest debt, such as credit card balances, can quickly accumulate, eroding your financial stability. Prioritize paying off high-interest debt to avoid the negative impact of compound interest on your liabilities.

Conclusion

Compound interest is a critical factor in achieving long-term financial growth. By understanding its principles and applying effective strategies, you can maximize your returns and build substantial wealth over time. In 2024, leveraging high-interest accounts, starting early, and making consistent investments are key to harnessing the power of compound interest. Remember to monitor your investments, reinvest earnings, and manage debt to ensure your financial strategy remains effective. With careful planning and informed decision-making, compound interest can be a powerful ally in your journey toward financial success.