Loan amortization is a crucial concept in personal finance and real estate investments. As we approach 2024, understanding how amortization works can help borrowers make informed decisions and manage their finances more effectively. This article will cover the fundamental concepts of loan amortization, provide insights into its calculations, and highlight key aspects to consider for the coming year.

What is Loan Amortization?

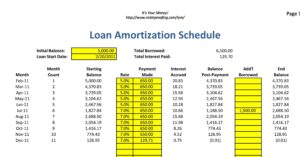

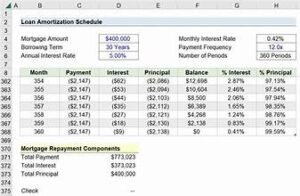

Loan amortization refers to the process of paying off a loan over time through regular payments. Each payment covers both principal and interest, gradually reducing the outstanding balance. The amortization schedule outlines how each payment is divided between principal and interest throughout the loan term.

Key Concepts of Loan Amortization

- Principal and Interest: The principal is the original amount borrowed, while interest is the cost of borrowing. Amortization ensures that each payment includes a portion of both principal and interest.

- Amortization Schedule: This is a table that details each payment’s breakdown, showing how much goes towards interest and how much reduces the principal. The schedule also displays the remaining balance after each payment.

- Fixed vs. Variable Rates: Fixed-rate loans have a constant interest rate throughout the loan term, leading to predictable monthly payments. Variable-rate loans, on the other hand, have an interest rate that can change periodically, affecting the payment amount.

- Loan Term: The loan term is the length of time over which the loan will be repaid. Common terms are 15, 20, or 30 years. Longer terms result in lower monthly payments but higher overall interest costs.

Calculating Loan Amortization

To calculate loan amortization, you need to know the loan amount, interest rate, and loan term. The following formula is used to determine the monthly payment:

M=P⋅r⋅(1+r)n(1+r)n−1M = \frac{P \cdot r \cdot (1 + r)^n}{(1 + r)^n – 1}M=(1+r)n−1P⋅r⋅(1+r)n

Where:

- MMM is the monthly payment.

- PPP is the principal loan amount.

- rrr is the monthly interest rate (annual rate divided by 12).

- nnn is the number of payments (loan term in months).

Example Calculation

Assume you have a $200,000 loan with a 5% annual interest rate for a 30-year term.

- Convert the annual interest rate to a monthly rate: 5%÷12=0.4167%5\% \div 12 = 0.4167\%5%÷12=0.4167% or 0.0041670.0041670.004167.

- Convert the loan term to months: 30×12=36030 \times 12 = 36030×12=360 months.

- Plug the values into the formula:

M=200,000⋅0.004167⋅(1+0.004167)360(1+0.004167)360−1M = \frac{200{,}000 \cdot 0.004167 \cdot (1 + 0.004167)^{360}}{(1 + 0.004167)^{360} – 1}M=(1+0.004167)360−1200,000⋅0.004167⋅(1+0.004167)360

M≈1,073.64M \approx 1{,}073.64M≈1,073.64

So, your monthly payment would be approximately $1,073.64.

Factors Influencing Amortization

- Interest Rate: A higher interest rate increases the total interest paid over the life of the loan. Even a small change in the interest rate can have a significant impact on the amortization schedule.

- Loan Term: Shorter loan terms generally have higher monthly payments but lower overall interest costs. Conversely, longer terms spread payments over a longer period, reducing monthly payments but increasing the total interest paid.

- Additional Payments: Making extra payments towards the principal can reduce the loan term and total interest paid. This can be a useful strategy for borrowers looking to pay off their loans faster.

Amortization and Financial Planning

Understanding loan amortization is essential for effective financial planning. Here are some tips:

- Review Your Amortization Schedule: Regularly reviewing your amortization schedule helps you understand how your payments impact the loan balance and interest costs.

- Consider Refinancing: If interest rates drop or your financial situation changes, refinancing your loan might be beneficial. This can lead to lower monthly payments or a shorter loan term.

- Budget for Extra Payments: If possible, budget for additional payments towards your loan principal. This can help you save on interest and pay off your loan faster.

- Consult Financial Advisors: For personalized advice and strategies, consult with financial advisors who can provide tailored recommendations based on your financial goals.

Conclusion

As we move into 2024, understanding loan amortization remains a vital component of effective financial management. By grasping the key concepts, calculations, and factors influencing amortization, borrowers can make informed decisions, optimize their loan repayment strategies, and better manage their finances. Whether you’re considering a new loan or evaluating your current one, a solid understanding of amortization can help you achieve your financial objectives and navigate the complexities of borrowing with confidence.