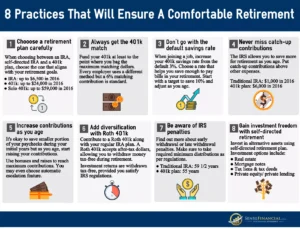

Planning for retirement can be a complex process, but understanding key financial figures can make it significantly easier. As we approach 2024, it’s crucial to stay updated on essential retirement planning numbers to secure a comfortable future. Here’s a comprehensive guide to the numbers you need to know:

1. Retirement Savings Benchmarks

To ensure you have a secure retirement, aim for these savings milestones:

- Age 30: Aim to have the equivalent of your annual salary saved.

- Age 40: You should have approximately three times your annual salary saved.

- Age 50: Target six times your annual salary.

- Age 60: You should have eight times your annual salary saved.

These benchmarks are general guidelines and may need adjustment based on your personal financial situation and retirement goals.

2. Retirement Contribution Limits

For 2024, the IRS has set the following contribution limits:

- 401(k) and 403(b) Plans: You can contribute up to $23,000 if you’re under 50. Those 50 and over can contribute up to $30,500 due to the catch-up contribution limit.

- Traditional and Roth IRAs: The contribution limit is $7,500 for individuals under 50. For those 50 and over, the limit increases to $9,000.

These limits allow you to save more as you approach retirement and help you build a larger nest egg.

3. Social Security Benefits

The full retirement age for Social Security benefits depends on your birth year:

- Born between 1943 and 1954: 66 years old.

- Born between 1955 and 1959: Incrementally increasing from 66 and 2 months to 66 and 10 months.

- Born in 1960 or later: 67 years old.

Early retirement benefits are available from age 62, but you’ll receive a reduced monthly amount. Delaying benefits past your full retirement age increases your monthly payment up to age 70.

4. Required Minimum Distributions (RMDs)

Starting at age 73 (as of 2024), you are required to begin withdrawing a minimum amount from your traditional retirement accounts. The amount you must withdraw is calculated based on your account balance and life expectancy.

5. Health Care Costs

Health care costs are a significant consideration in retirement planning. On average, retirees can expect to spend around $300,000 on health care throughout their retirement years. This estimate does not include long-term care expenses, which can be substantial.

6. Inflation Rates

Assume an average inflation rate of around 2-3% per year when planning for retirement expenses. This will help you estimate how much your savings will need to grow to maintain your purchasing power.

7. Withdrawal Rate

A common rule of thumb for retirement withdrawals is the 4% rule. This means you should plan to withdraw no more than 4% of your retirement savings each year to ensure your money lasts throughout retirement.

Conclusion

By understanding and planning for these essential retirement numbers, you can better prepare for a secure and comfortable future. Regularly review your retirement strategy and adjust as needed to stay on track.