Compound interest is a powerful financial concept that can significantly impact your wealth-building journey. Unlike simple interest, which is calculated only on the principal amount, compound interest takes into account not just the initial investment but also the interest accrued over time. In 2024, understanding compound interest is more critical than ever, as individuals and businesses alike seek effective strategies for financial growth. In this article, we will explore the fundamentals of compound interest, provide key calculations, and share practical tips for leveraging this concept to build wealth.

What is Compound Interest?

Compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. In simpler terms, it is the interest earned on interest. This compounding effect can lead to exponential growth of your investment over time, making it a key factor in wealth accumulation.

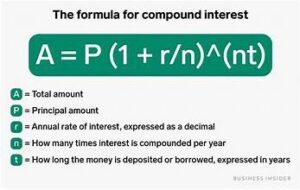

The Formula for Compound Interest

The formula for calculating compound interest is:

A=P(1+rn)ntA = P \left(1 + \frac{r}{n}\right)^{nt}A=P(1+nr)ntWhere:

- AAA = the future value of the investment/loan, including interest

- PPP = the principal investment amount (initial deposit or loan amount)

- rrr = the annual interest rate (decimal)

- nnn = the number of times that interest is compounded per unit ttt

- ttt = the time the money is invested or borrowed for, in years

Example Calculation

Let’s say you invest $1,000 at an annual interest rate of 5%, compounded annually for 10 years. Here’s how you would calculate it:

- Identify the variables:

- P=1000P = 1000P=1000

- r=0.05r = 0.05r=0.05

- n=1n = 1n=1 (compounded annually)

- t=10t = 10t=10

- Plug the values into the formula:

A=1000(1+0.051)1⋅10A = 1000 \left(1 + \frac{0.05}{1}\right)^{1 \cdot 10}A=1000(1+10.05)1⋅10

- Calculate:

A=1000(1+0.05)10=1000(1.05)10≈1000⋅1.62889≈1628.89A = 1000 \left(1 + 0.05\right)^{10} = 1000 \left(1.05\right)^{10} \approx 1000 \cdot 1.62889 \approx 1628.89A=1000(1+0.05)10=1000(1.05)10≈1000⋅1.62889≈1628.89

After 10 years, your investment would grow to approximately $1,628.89, meaning you earned about $628.89 in interest.

Why is Compound Interest Important?

Understanding compound interest is essential for several reasons:

1. Wealth Accumulation

Compound interest allows your money to grow exponentially. The longer you keep your money invested, the more interest you will earn, and the more substantial your total returns will be.

2. Retirement Planning

For those planning for retirement, compound interest can be a game changer. Starting to invest early can significantly increase your retirement savings, making it crucial to understand how it works.

3. Debt Management

On the flip side, compound interest can work against you when it comes to debt. High-interest debts, such as credit card balances, can accumulate rapidly, leading to a vicious cycle of debt.

Tips for Maximizing Compound Interest in 2024

Now that you understand what compound interest is and how it works, here are some practical tips to help you maximize its benefits and build wealth effectively in 2024:

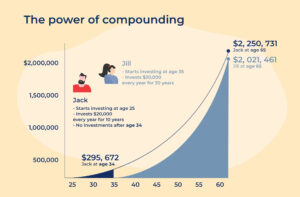

1. Start Early

Time is your greatest ally when it comes to compounding. The earlier you start investing, the more time your money has to grow. For instance, if you invest $100 per month starting at age 25 rather than age 35, you could potentially have thousands more by retirement.

2. Reinvest Earnings

To maximize compound interest, consider reinvesting any earnings or dividends. This practice allows you to benefit from compounding on your earnings, which accelerates your wealth-building journey.

3. Choose the Right Accounts

Certain accounts offer better interest rates and compounding frequencies. For example, high-yield savings accounts, certificates of deposit (CDs), and retirement accounts often provide more favorable terms than traditional savings accounts.

4. Understand Fees and Interest Rates

Be aware of fees associated with your investments and the interest rates you are paying on debts. High fees can erode your returns, while low-interest rates on debts can minimize losses.

5. Diversify Investments

Investing in a diversified portfolio can enhance your returns and provide a safety net against market volatility. Consider stocks, bonds, real estate, and other asset classes to take full advantage of compounding.

6. Utilize Tax-Advantaged Accounts

Take advantage of tax-advantaged accounts, such as IRAs and 401(k)s, to boost your savings. These accounts often have tax benefits that can enhance your overall returns, allowing you to maximize the effects of compound interest.

7. Regular Contributions

Make it a habit to contribute regularly to your investments. Even small, consistent contributions can grow significantly over time, thanks to compounding.

8. Monitor Your Investments

Keep an eye on your investment performance and adjust your strategies as needed. Understanding how your investments are compounding will help you make informed decisions about future contributions or reallocations.

Common Mistakes to Avoid

To make the most of compound interest, avoid these common pitfalls:

1. Delaying Investment

Waiting too long to start investing can drastically reduce your potential returns. The earlier you start, the better.

2. Ignoring Interest Rates

Failing to understand the interest rates on your loans or investments can lead to missed opportunities for growth or increased debt.

3. Overlooking Fees

Not paying attention to fees associated with your investments can diminish your returns. Always read the fine print and choose investments with low fees whenever possible.

4. Cashing Out Early

Withdrawing funds from your investments can halt the compounding process. If you can, let your money grow for as long as possible.

Conclusion

Understanding compound interest is essential for anyone looking to build wealth in 2024. By grasping the basic calculations, recognizing the importance of compounding, and implementing effective strategies, you can harness this financial concept to your advantage. Start investing early, reinvest your earnings, and choose the right accounts to maximize your growth potential. With careful planning and informed decision-making, you can set yourself on a path to financial success through the power of compound interest.