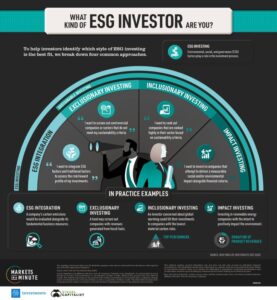

In recent years, Environmental, Social, and Governance (ESG) criteria have become increasingly important in the world of investing. These non-financial factors are used to evaluate the sustainability and ethical impact of an investment in a company or business. ESG financial ratios are critical in shaping the future of sustainable investing, influencing investor decisions, and driving the performance of socially responsible investments. In this article, we will explore how these ratios are changing the investment landscape and why they are essential for the future of sustainable finance.

Understanding ESG Financial Ratios

ESG financial ratios are quantitative measures used to assess a company’s performance in environmental, social, and governance areas. These ratios help investors determine the sustainability and ethical practices of a company, alongside traditional financial metrics. Key ESG ratios include:

- Environmental Ratios: These measure a company’s impact on the environment, such as carbon footprint, energy usage, water consumption, and waste management. Common environmental ratios include the Carbon Intensity Ratio (total carbon emissions divided by revenue) and Energy Efficiency Ratio (energy consumed per unit of output).

- Social Ratios: These focus on the company’s relationships with employees, suppliers, customers, and the communities where it operates. Examples include the Employee Turnover Ratio (number of employees leaving divided by total employees) and Diversity Ratio (percentage of minority or female employees in the workforce).

- Governance Ratios: These evaluate the company’s leadership, executive pay, audits, internal controls, and shareholder rights. Key ratios include the Board Diversity Ratio (percentage of women or minorities on the board) and Executive Compensation Ratio (CEO compensation compared to median employee salary).

Importance of ESG Financial Ratios in Sustainable Investing

Enhanced Risk Management

Investors use ESG financial ratios to identify and manage risks that are not apparent through traditional financial analysis. For instance, a high Carbon Intensity Ratio might indicate potential regulatory risks or future costs related to carbon emissions. Similarly, poor governance ratios might signal risks related to corruption, legal issues, or poor management practices. By incorporating ESG ratios, investors can gain a more comprehensive understanding of a company’s risk profile.

Better Long-term Performance

Studies have shown that companies with strong ESG practices tend to outperform their peers in the long term. ESG financial ratios help investors identify companies that are likely to be more sustainable and resilient over time. For example, companies with high energy efficiency or low employee turnover are often better positioned to achieve long-term success. As a result, ESG-focused investments can deliver superior returns compared to traditional investments.

Alignment with Ethical Values

ESG financial ratios enable investors to align their portfolios with their ethical and social values. Investors increasingly want to support companies that contribute positively to society and the environment. By using ESG ratios, investors can select companies that demonstrate a commitment to sustainability, social responsibility, and good governance. This alignment with personal values can enhance investor satisfaction and engagement.

Regulatory and Market Pressure

Governments and regulatory bodies worldwide are increasingly mandating ESG disclosures and reporting. Companies are required to provide transparent information on their ESG performance, leading to the widespread adoption of ESG financial ratios. Additionally, market pressure from consumers, employees, and stakeholders is pushing companies to improve their ESG practices. Investors who incorporate ESG ratios are better prepared to navigate these regulatory and market dynamics.

How ESG Ratios are Influencing Investment Strategies

Integration into Traditional Financial Analysis

ESG financial ratios are becoming an integral part of traditional financial analysis. Investors and analysts are incorporating ESG metrics alongside traditional financial ratios to assess a company’s overall performance and sustainability. This holistic approach provides a more accurate and comprehensive evaluation of an investment opportunity.

Development of ESG-focused Investment Products

The rise of ESG financial ratios has led to the development of a wide range of ESG-focused investment products, such as mutual funds, exchange-traded funds (ETFs), and index funds. These products are designed to provide investors with exposure to companies that excel in ESG performance. ESG ratios are used to construct and manage these portfolios, ensuring that they meet the desired sustainability criteria.

Influence on Corporate Behavior

As investors increasingly rely on ESG financial ratios, companies are motivated to improve their ESG performance to attract investment. This has led to positive changes in corporate behavior, with companies adopting more sustainable practices, enhancing transparency, and improving governance structures. The focus on ESG ratios is driving a broader shift towards sustainability in the corporate world.

Challenges and Future Directions

Standardization of ESG Ratios

One of the main challenges in using ESG financial ratios is the lack of standardization. Different organizations and rating agencies use various methodologies to calculate ESG ratios, leading to inconsistencies. Efforts are underway to develop standardized ESG reporting frameworks, which will enhance comparability and reliability.

Data Availability and Quality

The availability and quality of ESG data can vary significantly between companies and regions. Ensuring accurate and comprehensive ESG data is essential for the effective use of ESG financial ratios. Advances in technology, such as artificial intelligence and big data analytics, are improving the collection and analysis of ESG data.

Integration with Financial Performance

Integrating ESG financial ratios with traditional financial performance metrics remains a challenge. Investors need to develop models that effectively combine these different types of data to provide a holistic view of a company’s performance. Ongoing research and innovation in financial modeling are addressing this challenge.

Conclusion

ESG financial ratios are shaping the future of sustainable investing by providing critical insights into a company’s environmental, social, and governance performance. These ratios enhance risk management, support long-term performance, align investments with ethical values, and respond to regulatory and market pressures. As the importance of ESG factors continues to grow, ESG financial ratios will play an increasingly vital role in investment decision-making, driving the transition towards a more sustainable and responsible financial system.